Airbnb Investment Loans

Designed for Real Estate Entrepreneurs

buy properties with no personal income

Flexible Mortgage Solutions for Short-Term Rentals & Airbnb Hosts

Peace of Mind

Create more separation between your personal life and your business with features like limited recourse

Cost savings

With economies of scale across your portfolio, we’ll work with you to craft a loan with tangible cost savings when compared to your individual rental properties

Operational efficiencies

With one monthly payment for all of your rental properties - underpinned by a simple process - you can free up time and cash to focus on growing your business

Competitive rates

Competitive rates and favorable terms based on your portfolio make up and FICO score. And the terms only get better as your portfolio grows

# ABOUT US

We Are Fully Dedicated To Support You

A DSCR (Debt Service Coverage Ratio) Purchase Loan primarily focuses on the income-generating potential of the property being purchased, rather than the borrower’s personal income, providing investors with a financing solution that is directly aligned with the property’s ability to service its own debt.

No Personal Income Required

Based on Rental Income (Airbnb, Vrbo, Short-Term, or Long-Term)

Fast Approvals & Easy Process

Turn Stays Into Paydays—We Finance Airbnb Dreams.

Purchase

No traditional income verification needed—we use the property’s projected rental income to qualify you. Buy with confidence knowing you’re backed by financing that understands the short-term rental market.

No personal income required

Airbnb-friendly loans

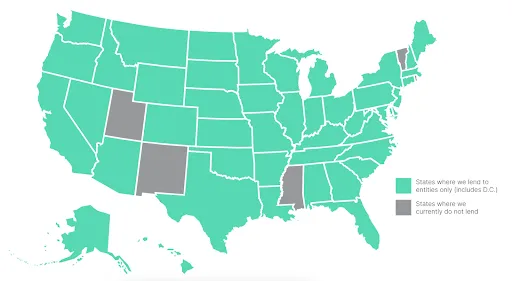

Fast approvals in 45 states

Refinance

Our easy financing options can help you access the funds you need for property improvements, whether it's remodeling the kitchen, adding a pool, or updating the decor to attract more guests. We make it simple to tap into your property’s value so you can boost your rental income and guest experience.

Lower your monthly payments

Unlock equity for new investments

Switch to a more flexible loan

# WHERE WE LEND

Rates as low as 6.75%*

Cash-out refinances after a property is owned for 90 days or is free and clear

Flexible DSCRs as low as 0.8X

5/1 ARM, 7/1 ARM, 30-year fixed, and interest-only options

Purchase, delayed purchase, rate/term refinance, and cash-out refinance options

No cap on the number of rental loans financed

Building an Airbnb Property Portfolio: Your Path to Early Retirement

In today’s investment landscape, owning a portfolio of Airbnb properties has become one of the most powerful strategies for generating passive income and achieving early retirement. ...more

Benefits

May 08, 2025•2 min read

Do You Have Questions?

How We Use AirDNA for Airbnb Financing

We use AirDNA’s Rentalizer tool to estimate how much a property can earn as a short-term rental. It compares similar nearby listings and factors in market trends like seasonality and rental demand. This data helps us offer financing based on the property’s income potential making it easier to invest in profitable Airbnb properties. You can use this app at https://www.airdna.co/airbnb-calculator

How much can I make on Airbnb?

How much you can make on Airbnb depends on the property’s location, size, and occupancy rate. In high-demand areas like Florida, it's common to earn $35,000 to $85,000+ per year, depending on factors like number of bedrooms, amenities, and seasonality. We use tools like AirDNA’s Rentalizer to estimate your potential income based on similar nearby rentals.

How do I estimate the Airbnb income for a specific property?

Have a specific property in mind? Just enter the address into the Rentalizer Airbnb calculator, confirm the number of bedrooms, bathrooms, and guest capacity, and adjust for any setup or operating costs you know. The tool then estimates potential income based on the actual performance of similar nearby rentals—giving you a realistic projection of what that property could earn as a full-time Airbnb.

Is investing in a vacation rental worth it?

Investing in a vacation rental offers great perks—from generating extra income to enjoying your own family getaway. However, choosing the right property is essential for long-term profitability. Before going under contract, use a trusted Airbnb calculator to estimate its potential rental income and make a well-informed decision.

Find a prospective Airbnb for sale

Find your next profitable short-term rental with accurate revenue projections based on real market data.

List of properties for sale

Testimonials

People Love Us

Thank you for helping me secure the financing I needed to start investing in Airbnb properties. With your guidance, I was able to buy multiple rentals and turn a dream into a profitable reality. I’m now earning steady income and couldn’t have done it without your support!

Zahra Wulf

Thanks to your help with financing, I was able to start investing in Airbnb properties right here in Florida. I’m now a Superhost, managing not only my own profitable rentals but also properties for other investors. You helped me turn my passion into a thriving business — I couldn’t be more grateful!

Elena Briand

Copyright 2025 . Commercial Loans Florida or CLF. All rights reserved

*Rental loan rates are based on loan terms, borrower qualifications, LTV, and property factors and are subject to change. Non owner-occupied rental properties only. Loans for business purpose only.

Loans available in AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MT, NC, NE, ND, NH, NJ, NV, NY, OH, OK, OR, PA, SC, SD, TN, TX, VA, WA, WI, WV, and WY as well as Washington D.C.